-

• #16553

Talk to Neezam - http://www.themortgagebroker.co.uk/member/neezam-romjon

-

• #16554

Getting there quite quickly now! Full mortgage application has been approved subject to valuation which is happening this Thursday. Fuck, this might actually happen. This house buying is a bit of a roller coaster isn't it!

-

• #16555

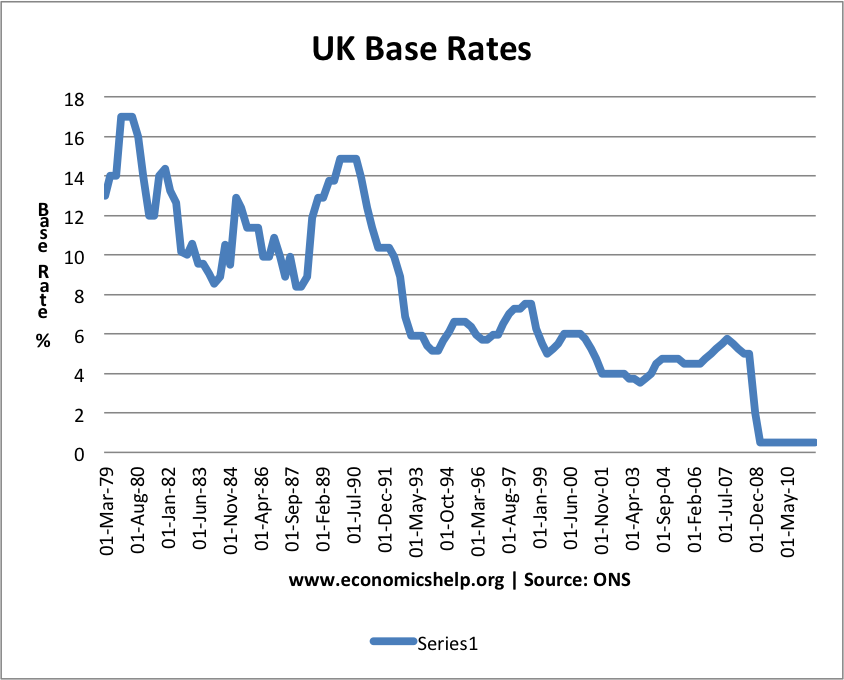

With political and probably economic funtimez ahead and cheap fixed deals around it would take a lot to convince me a tracker was a great idea :)

-

• #16556

I was discussing this with a mate at work. The conclusion was that if you can predict property price changes, interest rates and the rest in this current climate then you can probably make enough money that you don't need a mortgage.

(I'd go fixed, probably a 5 year for security. My mate's theory was a 2 year, at which point you'll be able to get a better 5 year as property prices will have risen and interest rates won't as they'll all kick off in 2019 post-actual-Brexit. Who knows.)

-

• #16557

My inclination is a 5-year fix, given the insanely low rates and potential for worldwide turmoil; but I have heard your mate's thoughts from a friend, also. Historically we've lost out by being on 5-year fixes, but that's because we bought our first place in 2006 - just before the crash. Guess it could go either way still, but ultimately we'd be better off paying a bit over the odds rather than 'oh shit' loads.

-

• #16558

Just think of it as buying insurance, not paying over the odds.

We are all paying way under the odds right now, right?

I'm not sure I understand the not needing a mortgage thing.

-

• #16559

I'll be getting another 2 year fix in the spring, and then a 5 year deal thereafter.

Don't be scared about rates going up. If they do, it'll only be by a small bit, and it'll probably be leaked well in advance .

-

• #16560

Does anyone recommend a particular one of those mortgages where you can offset savings and get them out again? Could it be worth trying to change mortgage sooner than the end of a fixed (couple years away)

Scenario is that we both have savings that we'd like to put towards overpaying, reducing interest and debt, and neither of us are clever investors. However, we're not overpaying because at some point one of us will probably want to take on the whole mortgage and we'll need the savings. I think. But it seems madness not to be reducing debt while we can. -

• #16561

We offset with YBS, they seem to have the best rates for fixed offset. I've always been happy with our interactions with them. In fact they were amazing when Brexit happened six days before our completion and we worked with them to switch from 2 year to 5 year fixed.

Our reason for offset is that a self employed income means that the tax money that is saved over the year can contribute to the mortgage until it gets handed to hmrc.

-

• #16562

Anyone know how long it takes to hear back from the valuer? The property that we're buying is being valued today by Colleys (through the Lloyd's group) and keen to understand the time frames involved. Anyone had any experience with Colleys? It's just the basic type 1 valuation I think.

-

• #16563

They usually just drive past to check it exists. You should have the valuation approved by the end of the week if you chase up Lloyds...

-

• #16564

It was same day in our case. Can't remember who the Halifax used for the valuations but they 'valued' at 9.30am and our broker had received confirmation they were happy with the purchase price by lunchtime.

-

• #16565

I'm still dithering over what blinds to get. Thinking now of going for a roller blind for the bedroom. It's a very large window. My concern is whether I'd be bothered not being able to regulate the light (it's either up or down). Also, do these guys look reasonable (any experience of them)?

-

• #16566

Thanks

-

• #16567

Yep, it's Colleys that Halifax use. I'll hopefully hear something soon.

-

• #16568

Edit - see below

-

• #16569

Can't see link. Am I not cool enough?!? :)

-

• #16570

OT/WANTED: mrs_com works with vulnerable and at risk young people. One of the people she has been working with has just, after a year of being in and out of hostels/refuges, been allocated her own flat.

This is awesome (for many and varied reasons) but it is currently unfurnished and after arranging her deposit and paying off the (much more expensive) hostel place they have about £15 left.

Does anyone have any furniture or appliances they are looking to get rid off for free or in exchange for services provided by myself?

I believe she needs everything from a kettle to a bed. mrs_com is pursuing other resources obviously but if anyone needs rid of something in decent or serviceable knick, let me know.

The flat is in Islington and I do not have a car so local stuff appreciated but depending on need/offer I will work out how to get stuff moved around.

Any offer is appreciated.

-

• #16571

New post

-

• #16572

They may pop in to measure the square footage as well. Normally a pretty straight-forward procedure.

-

• #16573

What sort of size is the place?

-

• #16574

How about cash monies?

-

• #16575

I believe one bedroom but will find out on Saturday if that actually means "studio".

Timmy2wheels

Timmy2wheels Hefty

Hefty Howard

Howard hoefla

hoefla mashton

mashton Soul

Soul dwl

dwl stevo_com

stevo_com Dammit

Dammit Aroogah

Aroogah @Hobo

@Hobo

at the moment it is somewhere to live. back in 1997, it was a pragmatic decision as well.

we were living in one room sub let of a housing association place in Chalk Farm.

walthamstow was cheap. I knew the area a little. we needed somewhere to live. we bought somewhere to live.

if only it were that simple for people now...