-

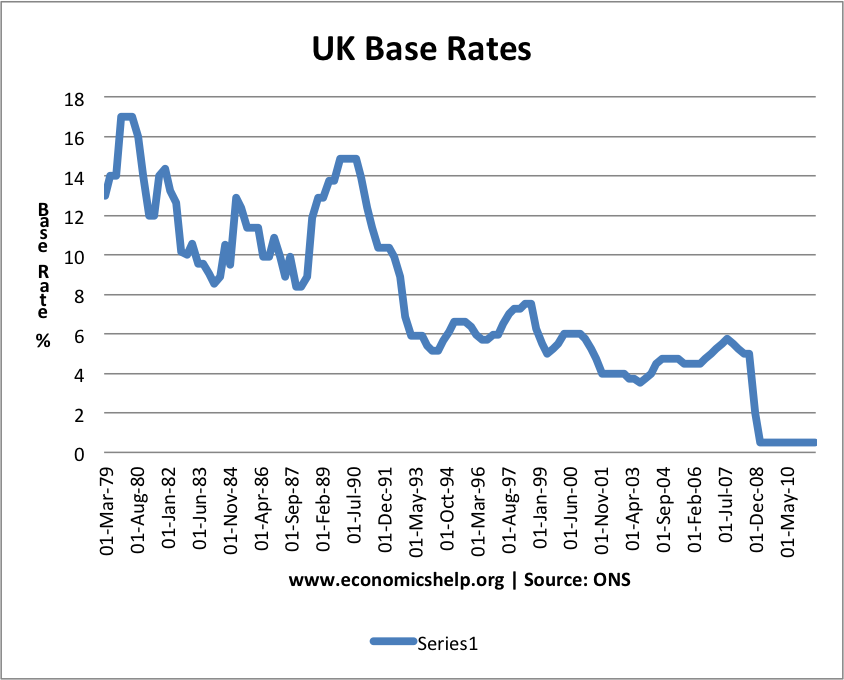

My inclination is a 5-year fix, given the insanely low rates and potential for worldwide turmoil; but I have heard your mate's thoughts from a friend, also. Historically we've lost out by being on 5-year fixes, but that's because we bought our first place in 2006 - just before the crash. Guess it could go either way still, but ultimately we'd be better off paying a bit over the odds rather than 'oh shit' loads.

You are reading a single comment by @Timmy2wheels and its replies.

Click here to read the full conversation.

Timmy2wheels

Timmy2wheels Howard

Howard

I was discussing this with a mate at work. The conclusion was that if you can predict property price changes, interest rates and the rest in this current climate then you can probably make enough money that you don't need a mortgage.

(I'd go fixed, probably a 5 year for security. My mate's theory was a 2 year, at which point you'll be able to get a better 5 year as property prices will have risen and interest rates won't as they'll all kick off in 2019 post-actual-Brexit. Who knows.)