-

• #2

Just got my recent credit card bill - 88% was spent in bars or restaurants. That seems quite ridiculous. Most bills are direct debit so I'm not sure what that is as an overall factor but it's relatively high.

-

• #3

After bills and bikes, the rest goes towards renovating the new apartment and overpaying on the loan, so nothing gets transferred to the next month. I do put ~100£ more into my budget account than needed, so have a small buffer there...

-

• #4

after rent and bills, 90% goes on a combo of food shopping eating out and beer, whatever left goes on bike shit.

-

• #5

I seem to spend most money on flat whites, bitter and Japanese takeaways.

Currently have 67p savings. -

• #6

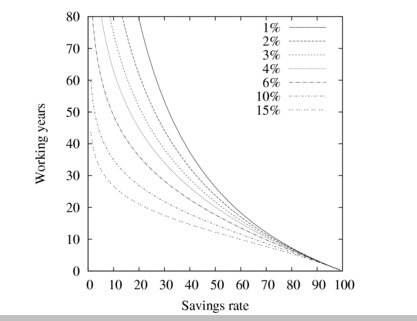

save 37% of gross pay

57% of net payover the last 3 years

-

• #7

Just got my recent credit card bill - 88% was spent in bars or restaurants. That seems quite ridiculous.

Is this surprising for a fatty? ;)

Seriously though I'm one of the middle two but the wording has confused me so I'm not sure which.

I know how much I save but I don't actually know the breakdown, I should really. Other half has just started recording everything he spends and doing a budget, I should probably do this really.

-

• #8

save 37% of gross pay

57% of net payover the last 3 years

Your Ti bike is due soon.

-

• #9

I dont work to want.

-

• #10

Salary to salary...

-

• #11

I try to save each month, but the amount I put away at the beginning of the month is almost always identical to the amount I need to bail myself out of poverty at the end of the month....

-

• #12

-

• #13

Saving = losing value of money.

Any spare goes to something that may increase in value overtime like piece of art, member #2, vintage bike, vinyl, microcosm ...

hippy

hippy JesperXT

JesperXT rogan

rogan EEI

EEI dicki

dicki Fox

Fox DethBeard

DethBeard dapthechap

dapthechap Eejit

Eejit

skydancer

skydancer

What percentage of your outgoings do you let go of?

What do you spend it on? Break it down