-

• #54252

Yeah, you sell the house to pay off the outstanding mortgage balance then get a new house with a new mortgage. You may be able to port your existing mortgage to the new house but it'll be at current rates so no real benefit to just getting a new one

-

• #54253

It is an area where there are loads of spurious claims and "reclaim agents" helping people to ask for sdlt back if they didn't claim mdr but could have done.

How much non-residential will the property have and what is it?

I think HMRC are looking at it but I'd be surprised if any change is retrospective

So I’ve heard. If we decide to do it, we wouldn’t be applying retrospectively and there’s no agents involved. It’s simply that our conveyancing solicitor dealing with our purchase raised the point that it appears to qualify and is asking if we want to apply the relief when paying the SDLT on completion.

The house is a Victorian semi which the previous owners extended to create a ground floor kitchen and a first floor annexe/granny flat. That annexe comprises a separate entrance from the drive, a kitchen, living room, bedroom, bathroom and conservatory (see floorplan). It’s completely self contained with its own gas boiler and electrics, but not sure about water supply. There is also access from the main house, but only via a door that’s lockable. So it seems to meet all of HMRC’s criteria for a separate dwelling I can find online. However no one is willing or able to give a definitive “yes, it qualifies “ when asked and as it’s a self assessment tax the responsibility is totally on us. What I don’t want is to apply it and then HMRC to then disagree at some point down the line and demand the money plus interest.

We could pay a SDLT expert to advise, but the cost of that is about 20% of what we’d save, so a sizeable chunk and no guarantee even if they said yes that HMRC wouldn’t disagree anyway.

What I want is a service from HMRC to allow me to proactively check if we qualify and for them to either give us a straight yes or no. But of course they won’t do that.

Edit - ignore the red border on attached floorplan, it’s left over from something else.

1 Attachment

-

• #54254

I think it's worth asking your mortgage provider. They can tell you whether your existing mortgage is portable and details of any fees etc

-

• #54255

It's a risk reward calculation. The difference between 1.5 and 2.5 % is a lot less galling if you guess wrong than double digit %s if rates ever go back there.

Yep, this...we've just got a mortgage sorted for (hopefully!) a new place and opted for a 10yr fix at 3.38% which was 0.05% more than the 5yr at the time. Worst case rates drop down again and we miss out on a cheaper final five years, 'best' case they don't and we know what we're paying for a long time and don't have to worry about any more rearranging fees until 2032.

Slightly galling going over the workings from the start of January that shows a rate of 1.44% for the same amount and LTV...hey ho, shame there wasn't a property available then for us...

-

• #54256

Thank, that’s reassuring, slight benefit of London is that it make place like Sheffield, a Glasgow, etc. so much cheaper.

-

• #54257

Yeah definitely, we're buying a 3 bed with garden and garage 3 miles from the center of Manchester for the price of a 1 bed flat somewhere shit in London

-

• #54258

Private pensions are just long term investments / stocks and shares portfolios.

If they funded other peoples pensions; that would be a pyramid scheme.

You can divest fully from certain types of stocks too. I have opted out of fossil fuels & any businesses involved in the weapons trade for example.

-

• #54259

The rates I got, which may have gone up now, and we’re with my current provider so an additional Mortgage, worked out at approx £50 a month for every 5k, over about 22 years.

Hope that’s of some help. -

• #54260

Cheers, very helpful. Think I will be waiting until we're no longer paying nursery fees.

-

• #54261

separate council tax?

-

• #54262

I’m enquiring, but don’t believe so.

Having read all of the HMRC docs relating to this, it seems having separate council tax isn’t given much weight.

The more I read, the more I feel this property ticks all of the boxes required. The thing that makes me hesitant is I’m not sure what the financial penalties would be if HMRC decide we are wrong at some point. I’m happy to just leave that money in a savings account in case they come knocking, but not if they’re gonna also charge 100’s in interest too. And I want to know how long until they have to make a decision. More reading to do.

-

• #54263

Unlock the door and change the occupancy?

-

• #54264

-

• #54265

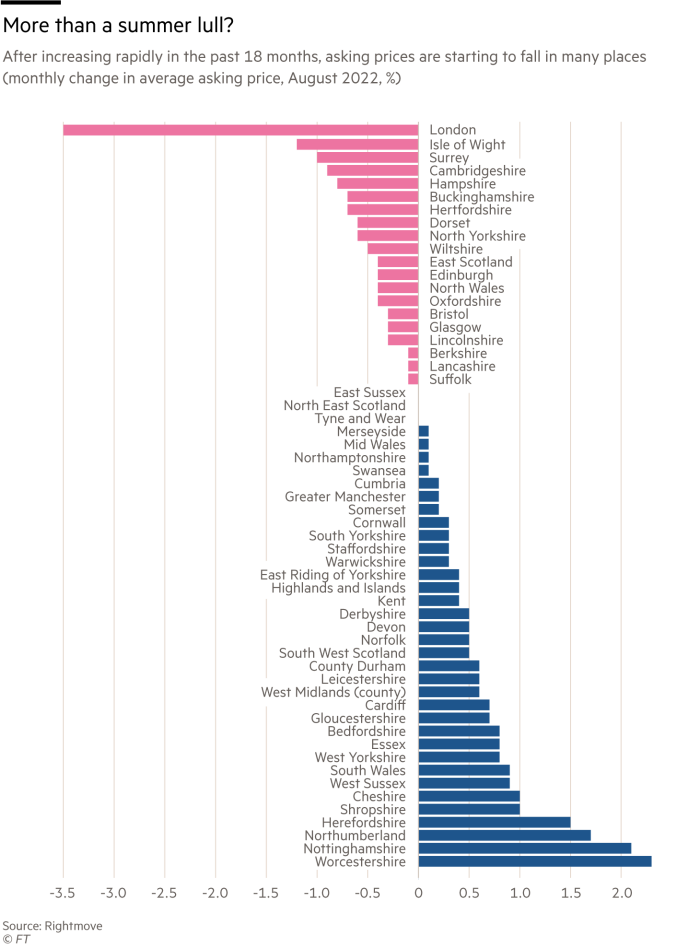

This is the start of it.

-

• #54266

My heart bleeds for some of the people the FT interviewed

Already, higher rates are forcing some homeowners to sell up. Sarah and her brother Dom co-own a flat in west London which they rent out. They have a variable-rate mortgage, meaning their monthly repayment rate closely tracks the Bank of England’s base rate decisions. Thanks to rate rises, the cost of servicing the mortgage has “gone up massively so it’s not really worth renting out anymore. We’re in the process of selling up,” says Sarah.

-

• #54267

If your "business" can't survive 1.75% base rates you are taking the right decision in selling up

-

• #54268

You may be able to port your existing mortgage to the new house but it'll be at current rates

Not necessarily, I have ported my old fixed rate to a new property. The property is cheaper, I'm paying back some of the mortgage balance therefore the LTV has changed so a small proportion of the new mortgage is at current rates, because my old mortgage had a minimum LTV which was no longer satisfied.

-

• #54269

Yeah I meant in that situation where Ed had left the 5 year fixed to run out. He'd need to remortgage anyway so if it was a port or a new mortgage either would be at current market rates.

-

• #54270

Different situation for me but I ported my old 5yr fixed mortgage at old rates and got a top-up second 2yr fixed mortgage from the same provider at new rates.

-

• #54271

Will be devvo for Sarah and Dom if they can't find buyers or renters and are stuck paying their new mortgage rate

-

• #54272

can't find buyers or renters

Obviously you can always find a buyer, just not necessarily at a price that delivers the profit you feel you are entitled to.

The idea that "purchase price plus stamp duty" is some kind of floor below which you never have to sell a property may get tested over the next few years.

-

• #54273

daddy will be miffed at the lack of roi on his sw4 investment

-

• #54274

Different situation for me but I ported my old 5yr fixed mortgage at old rates and got a top-up second 2yr fixed mortgage from the same provider at new rates.

Did this too. 'Oh, we'll just go on the SVR for a few months when the 2 year fix ends and remortgage them both together at a lower rate.'

hahahahhaha

-

• #54275

I've ran the numbers on similar situations before and I can't see how an average rental in London makes any profit unless you bought it 10 years ago or have already paid off the mortgage. I see online people mentioning 6% yield rates but no way that can happen if you buy somewhere new. For example

Lewisham, 2 bed flat in a Georgian terrace, with 5.5% buy to let mortgage is £1797 a month.

https://www.rightmove.co.uk/properties/125674835

A very similar 2 bed flat to rent a couple of streets away is £1800.

https://www.zoopla.co.uk/to-rent/details/61651959My point is landlords are scum but people trying to buy in to it now are extra stupid scum.

Sumo

Sumo

rhowe

rhowe tonylast

tonylast edscoble

edscoble Soul

Soul chrisbmx116

chrisbmx116 Mr_Smyth

Mr_Smyth Grumpy_Git

Grumpy_Git NickCJ

NickCJ konastab01

konastab01 leggy_blonde

leggy_blonde Tenderloin

Tenderloin umop3pisdn

umop3pisdn @Hobo

@Hobo

Isn't that the principle of mortgaging ? The property being just a security against the borrowing, unrelated to the actual place.

Might even be worth considering paying the penalty towards the end of the 5 years if conditions are in your favour (appreciation, right time to sell/buy, etc.)