-

• #1902

That's how things were in the later stages of the dot com bubble

-

• #1903

I….I mean wow

Poppies. Didn’t we learn from the poppies!

-

• #1904

Every time I watch this guy speak, I come away feeling more and more energised about bitcoin and its potential impact on a fairer, more financially inclusive society. A future where Lightning payments are accepted everywhere is a lot closer than you might think.

-

• #1905

potential impact on a fairer, more financially inclusive society.

The guy admits he is a libertarian so he will be looking to limit the role of governments or other 3rd parties in his life; small state, low tax, less services provided free at the point of access. He may think there is some utopia out there where everyone binds together and things get better with out a governmental structure but, even if he dresses and talks like a skater, he is a fin tech CEO born into high finance so I doubt it.

On another note, no matter how fast his transactions are, there must be a change in vale of BTC between the initial buy and the sell. Volume would make this not insignificant. Anyone know how they are managing that? Create a margin in the sale as a buffer. Come to think of it, he is selling it as a no cost transaction, how does his company plan to make a profit? Pull an Uber?

-

• #1906

He mentions that in the later videos. Strike is providing a banking service, so can monetise through credit cards, savings accounts, overdrafts etc. The lightning payments are just another service provided to their customers

-

• #1907

The lightning payments are just another service provided to their customers

kind of like how Visa use USDC on ERC20

-

• #1908

So he is running a trusted 3rd party to process payments and provide other banking services that he will profit from.

-

• #1909

I'm still confused about the energy calculations for a bitcoin transaction but this got me thinking again. 2 transactions per payment. Who pays for all that energy?

-

• #1910

I'm still confused about the energy calculations for a bitcoin transaction but this got me thinking again. 2 transactions per payment. Who pays for all that energy?

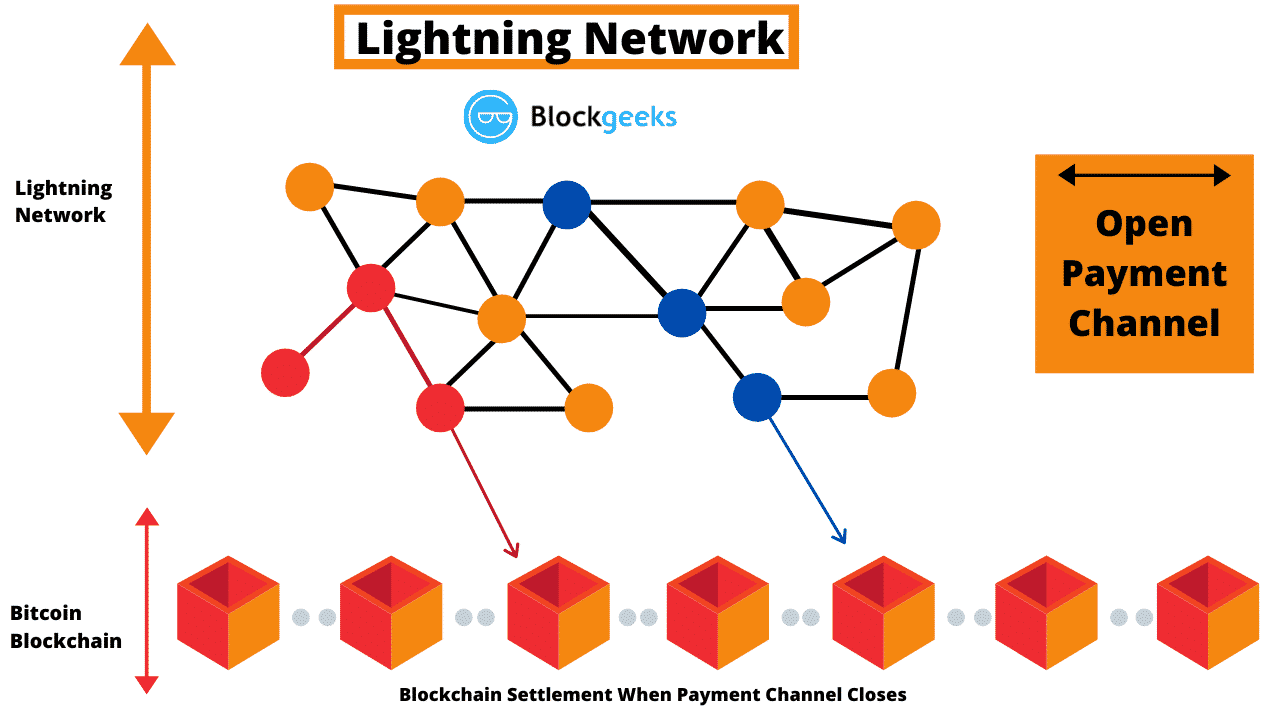

Its one transaction for the jump to the lightning network (creation of a payment channel) and one transaction for the jump back. They key thing is that you can have unlimited transactions on the lightning network for zero or near zero cost.

This means they can transaction batch.

I.e pay one fee to jump to lightning, process 2,000 transactions for their customers for example, and then pay one single fee to write those transactions back to the BTC chain.

Its kind of like how ImmutableX works on ethereum for minimising fees for NFT transactions.

-

• #1911

The guy admits he is a libertarian so he will be looking to limit the role of governments or other 3rd parties in his life; small state, low tax, less services provided free at the point of access. He may think there is some utopia out there where everyone binds together and things get better with out a governmental structure but, even if he dresses and talks like a skater, he is a fin tech CEO born into high finance so I doubt it.

Not really sure what you're getting at here? Whether he thinks the NHS is a shit idea or not, he's still working on an incredible tool of value exchange that anyone with a smartphone could theoretically access (and Strike isn't the only app to do it).

-

• #1912

I thought the quote in my comment have it context sorry. My point is that, as a lot of tech innovation has matured, the potential to do good has been lost as the big players, who burned investors cash to corner or create markets early on, squeeze everything for profit. Uber is a great example and the recently leaked emails show this was always the plan. Lighting would be more likely to go that way, cornered by a single company and squeezed to death.

-

• #1913

Ah yes, good idea. Do the 2 jumps happen instantaneously? I.e. can the price of BTC change between them?

-

• #1914

Some crypto courses someone I think is knowledgable recommended to me.

Edit: only the FREE courses. Fuck the pay for ones.

-

• #1915

Will they make me better at fomo buy high, panic sell low?

-

• #1916

fomo buy high, panic sell low?

Story of my life. Might as well just make a pile and set fire to it.

You should fomo buy now while it's all low.

-

• #1917

Earnings disclaimer is a whole thing!

-

• #1918

I mean the free courses. Don't waste your hard earned crypto profits on this course.

-

• #1920

How's that a thing... Jesus

-

• #1921

Was looking at my holdings last night, apart from my original stuff a lot of it I should have just put on the horses.

-

• #1922

But look at it in context, everything except gold has done badly.

-

• #1923

Pretty shocking news from FTX.com. I suspect we will never know the full story or what their financial picture looked like. Some institutional investors burned badly, no doubt.

-

• #1924

I've been working on a major release for a crypto project all day. Part of the product has a BTC price ticker in it. Haven't had time to figure out why we're down 10% today...this will be why I guess!

-

• #1925

Wow, CZ always keeping funds SAFU

frank9755

frank9755 Howard

Howard georgert

georgert dst2

dst2 Lebowski

Lebowski Stonehedge

Stonehedge ChainBreaker

ChainBreaker greentricky

greentricky EB

EB Ordinata

Ordinata konastab01

konastab01 NickCJ

NickCJ @hippy

@hippy

I'm pretty sure that a large majority of investors in traditional and crypto markets simply have no idea what they are investing in. I base that on the levels of shock I see when everything falls apart. Worse in blockchain for sure though.

I've lost count of the number of times I have encountered somebody who has invested tens of thousands in a project without either knowing what blockchain is or what the service that the company plans to provide will be. Shiny and colourful graphics is all that is needed to fleece people.