-

• #1877

In your chart they say they have 1.6% of their assets in digital tokens, = c. $1 bn. If those tokens go down in value by 20% they have no equity and their liabilities are worth more than their assets.

Is that true? If their digital token investments went to zero value would they have no equity? I don't understand how that would cancel out their cash reserves, precious metals, loan income, fiduciary deposits etc etc.

-

• #1878

Is that true? If their digital token investments went to zero value would they have no equity? I don't understand how that would cancel out their cash reserves, precious metals, loan income, fiduciary deposits etc etc

They have $68.1 bn in assets and $67.9 bn in liabilities, therefore book equity (or "capital") = 68.1 - 67.9 = $200 mm.

If you reduce assets by $200 mm due to credit losses / market declines then you (obviously) reduce capital by $200 mm as there would be no offsetting reduction in liabilities (because the liabilities are pegged to the dollar). Therefore your equity goes to zero and you have no headroom if all the depositors wanted their money back.

This is why banks have capital (a surplus of asses over liabilities) to absorb losses.

-

• #1879

Tether doesn't appreciate the fud

https://tether.to/en/tether-condemns-false-rumours-about-its-commercial-paper-holdings/They also claim they are working on a full audit

https://www.euromoney.com/article/2a8dpi4tnxahuu98a251c/fintech/cryptocurrencies-tether-is-open-to-providing-more-information -

• #1880

Jul 2021:

Tether General Counsel Tells CNBC Audit Is 'Months' Away

2018:

Tether reluctantly agreed to conduct a public audit. Traders waited for the report to be issued, but as delays mounted up, commenters ventured that the audit would never be published. It appears they were right

-

• #1881

Lol yeh they had an auditor appointed before who walked away after they weren't allowed to see the full accounts

-

• #1882

if all the depositors wanted their money back.

Do banks have to hold enough equity to cover a 100% withdrawal rate?

-

• #1883

Do banks have to hold enough equity to cover a 100% withdrawal rate?

Yes - all banks not in financial distress will have a surplus of assets over liabilities as well as loan loss allowances, effectively deductions from the asset side of the balance sheet to account for hypothetical future credit losses. A typical ratio of equity to assets is 5-10% depending on how risky the loan book is.

If you take a typical mid-sized bank like OSB (which focuses on specialist property lending), you can see from their annual report (p. 181) that they have £25 bn assets (net of £100 mm allowance for credit losses) versus £23 bn of liabilities, leaving £2 bn of book equity (8% of assets). Approx 30x Tether's capital ratio.

However, versus Tether their asset book is more illiquid - so if the £5 bn of their liabilities that are repayable on demand were to ask for their money at the same time, they would quickly exhaust their £2.7 bn of cash on hand and have to start running down the loan book (or securitising it and pledging it to the BoE as repo collateral).

You can decide which you prefer!

https://www.osb.co.uk/investors/results-reports-presentations

EDIT: to summarise all the above, the point is that in an orderly liquidation of OSB you would expect all the depositors to get their money eventually (like the Lehman creditors did). I would be pretty sure that some depositors would get impaired if Tether were liquidated.

-

• #1884

Interesting thread on stable coin liquidations https://twitter.com/milesdeutscher/status/1538918950909919232

-

• #1885

I know what you are saying makes sense but for some reason your assessment of the risk doesn't line up with opinions I'm hearing from people who's job it is to assess Tether's risk ....I'm obviously misunderstanding something along the way. If might DM if thats ok!

-

• #1886

I didn't realise that they have ignored the DAO decision, that really does seem a dubious precedent for the protocol although understand why the DAO can feel flawed if it goes on stake size. The whale probably could of voted against and heavily influenced the vote

-

• #1887

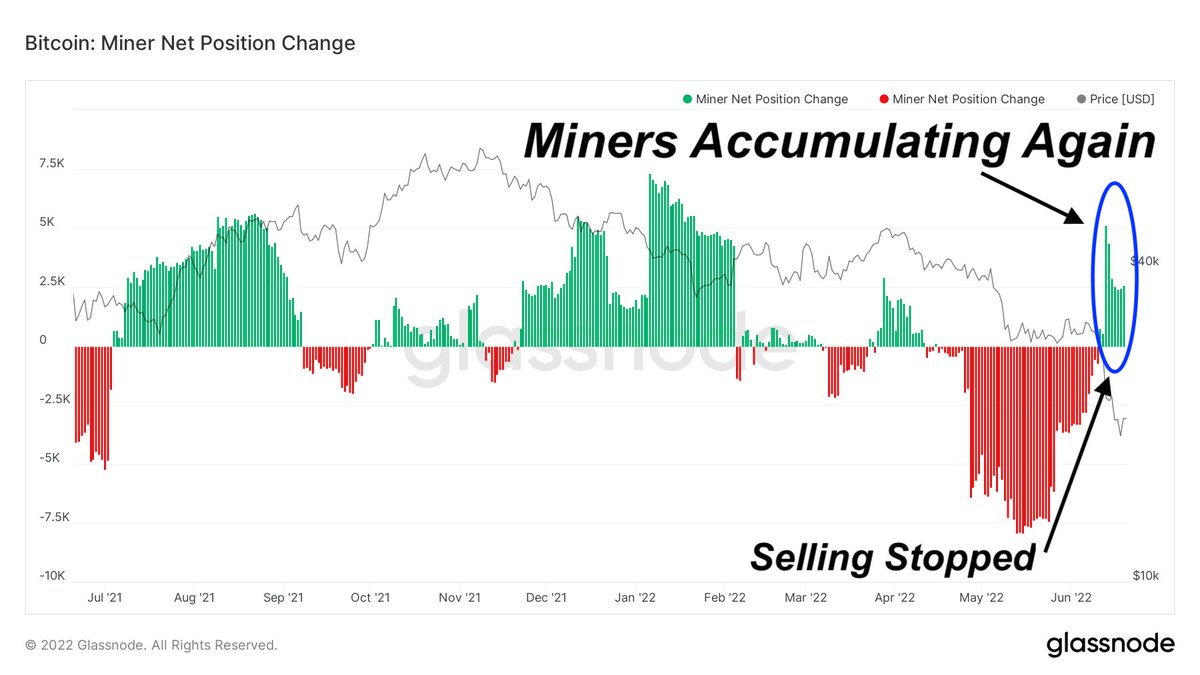

Miners back accumulating

-

• #1888

What does that mean? Miners have stopped selling the bitcoin they mine?

-

• #1889

Yes it doesn't currently cover production costs

https://en.macromicro.me/charts/29435/bitcoin-production-total-cost -

• #1890

If might DM if thats ok!

Go for it! I'm coming at all this from a TradFi lens - for work I invest in banks / insurers / fintechs so can't speak to the tech side, but I think I have a good understanding of how to run a leveraged balance sheet safely.

-

• #1891

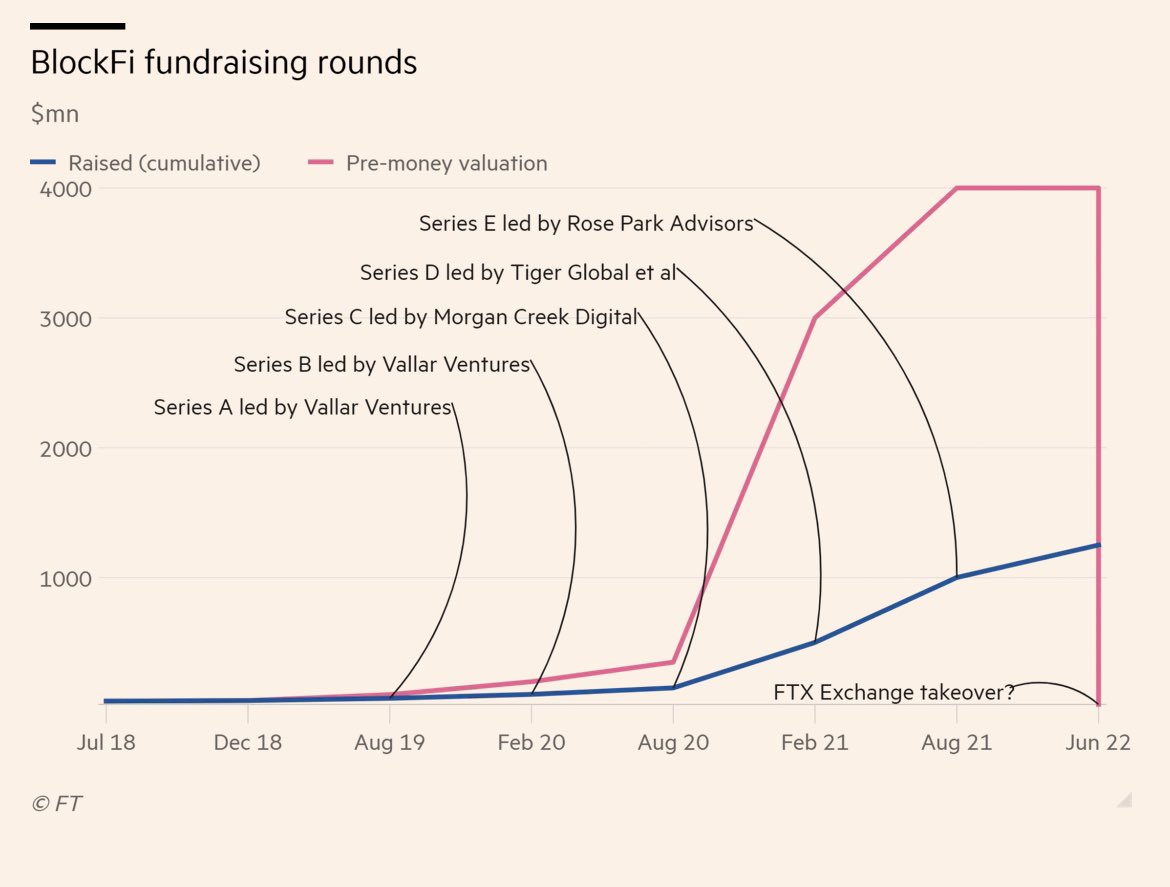

Ouch

Want to see what that value destruction looks like in graph form? Here you go.

https://www.ft.com/content/68a04a85-07d2-42ba-8ae2-ceb832a6742e

-

• #1892

What the fuck is wrong with people?

-

• #1893

This popped up on my Twitter feed this morning. I suspect the small print makes it less interesting than it seems, but a lifetime Netflix or Spotify subscription for $349 seems like a good deal?

Presumably you are taking their credit risk to keep paying the monthly charges and who knows whether they will be around when I'm in my 90s. I would be interested to see their business plan!

-

• #1894

who knows whether they will be around next year

-

• #1895

Indeed. I haven't dug into it enough to figure out whether I'm taking that risk or whether it falls to Netflix / Spotify.

-

• #1896

It’s nothing to do with Netflix or Spotify. You’re not buying a lifetime subscription, you’re buying a pledge from Revuto to cover the Netflix subscription fees. If Revuto disappear then there’s nobody to pay the subs

-

• #1897

Ballsy

Can my NFT lose its value?

No. Your NFT should not lose its value with time, only the opposite. The value should go up because subscription prices will grow with time which means you should always be able to sell your NFT for at least the price you bought it at. After selling it, the Netflix or Spotify you were using during the time you owned the NFT shouldn't cost you a thing.

I guess there's a chance they won't have gone bust in a couple of years and you may break even.

Admittedly HMRC may have got them by then

Can I get a receipt for my NFT purchase?

With the help of ramp.network, Revuto is not selling but exchanging NFTs for the crypto you bought, so basically there's no purchase happening and that's why we're not obligated to issue you a receipt.

-

• #1898

blatant scam, come on..

-

• #1899

Revuto is not selling but exchanging NFTs for the crypto you bought, so basically there's no purchase happening and that's why we're not obligated to issue you a receipt.

Lol this is dodgy as fuck. If the business is worried about issuing a receipt there's something wrong :-D

-

• #1900

This is comic genius

Stonehedge

Stonehedge NickCJ

NickCJ greentricky

greentricky frankenbike

frankenbike cyclotron3k

cyclotron3k Howard

Howard @hippy

@hippy

I am hugely suspicious of their "commercial paper" holdings given that no-one in the market admits to seeing them as a buyer

https://www.ft.com/content/342966af-98dc-4b48-b997-38c00804270a