-

• #31402

I've not used them. I've used Stanza (i think they're called) and there's a little corner store near Westfields in Shep Bush that sells some Aussie bits.

-

• #31403

Pear Tree in Yeoman Street

-

• #31404

Fuck Brexit. Fuck the Tories.

Amen

-

• #31405

Maybe, but I'm still pissed, never had to pay before!

-

• #31406

Yeah, it's a kick in the dick. Meanwhile those fucksticks ruining the country are just off-shoring everything.

-

• #31407

Shop in England sends my parcel via dublin instead of directly here. Perhaps it's the fault of RM international (yeah they used it...not normal UK RM)

Now getting a customs fee. I've complained...learn some geography people, it's not ROI it's NI, UK.

(Though this "but where and what IS NI???" has gone on for ages)

-

• #31408

Custom fee refunded and the Irish postal service is very very slow, still not on the way.

The perfectly fine EUSS scheme continues to not function for the last tens of thousands stuck in the backlog.

-

• #31409

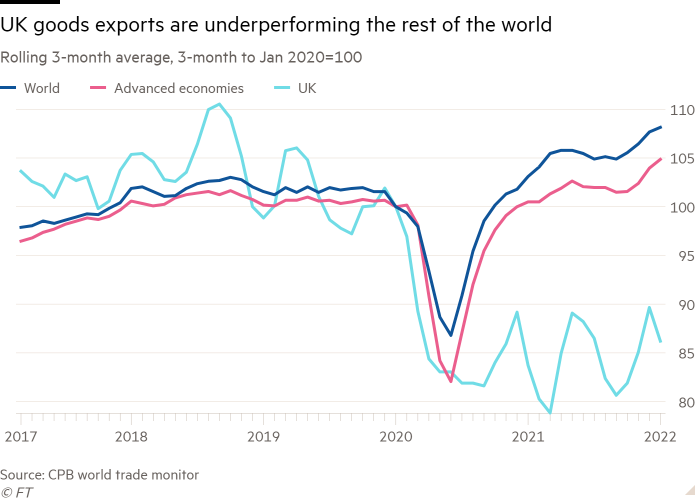

Brexit blamed as UK misses out on global trade rebound

UK goods exports have underperformed the rest of the world in what experts said was a sign that Brexit might be limiting the country’s trade performance.

The volume of UK goods exports fell 14 per cent in the three months to January compared with the same period in 2020, before the pandemic, according to the world trade monitor published on Friday by the Netherlands Bureau for Economic Policy Analysis, known as the CPB. This was in stark contrast to the global average of an 8.2 per cent rise over the same period.

Project fear, innit

-

• #31410

.

1 Attachment

-

• #31411

As anyone who isn't an utter fool could have (and, indeed, did) point out at the time.

-

• #31412

How to ruin your career in one easy step! ;)

-

• #31413

I’m driving to France in May with a boot full of ilea kitchen bits and tools - were fitting a new kitchen in my parents place.

Roughly half of the value of the kitchen is being bought in the uk, half in France due to availability.

Does anyone have any idea if we have to pay import duty and, if so, how?

.gov is fucking impenetrable.

-

• #31414

Depends on whether the kitchen qualifies as “made in UK” - if so, no duty, if you can prove that. Just VAT.

However- you may find it’s easier to a) not mention it and basically become a kitchen smuggler, or b) just pay the duty and VAT because that’s easier than documenting your kitchen’s status vis a vis preferential rules of origin regulations.

-

• #31415

take out the kitchen out of the cardboard packaging so it look like it's just a brunch of old IKEA furniture you flailingly taken apart.

-

• #31416

Does anyone have any idea if we have to pay import duty and, if so, how?

Put it in the boot, cover it in old blankets/towels/curtains and rock on through. Making sure it's no longer in IKEA packaging of course. 'Firewood for the parents, guv', if questioned, which you won't be. And on you trot...

-

• #31417

Border Force have had my new frame since the 28th, who’d like to nominate a date for when they finally inspect it?

-

• #31418

With a name like Border Force, I imagine they’ll let it go after giving it a good kicking… sorry, I meant ‘found it at the foot of the stairs.’

-

• #31419

How does one go about paying duty / VAT and where?

The .gov / EU sites are a maze of nothingness.

-

• #31420

It would be to the French, and would be if you went through the "something to declare" corridor (or are diverted through that due to a frankly unlikely inspection).

The French customs would assess what you owe, but I don't know what happens beyond that - whether it's a case of paying there and then or being issued with an invoice.

-

• #31421

Thanks. I was assuming there would be some sort of ability to pre-declare online to save time at Eurotunnel. Silly me.

-

• #31422

Anpost in Ireland is taking ages to post my light to NI, but they inspected and slapped a custom fee on it in just three days.

Not sure I got a free kick about with it :)

-

• #31423

If the customs stop you and search your car (they never have with us) then if you can't convince them it's yours, older than 6 months old, etc then you'll pay there and then or be told to present yourself at the customs office to pay the VAT & duty, which won't be much

But you are extremely unlikely to be stopped.

-

• #31424

Someone needs to change thread title to ‘post Brexit vat fraud tips’

-

• #31425

hippy

hippy JurekB

JurekB eskay

eskay Bernhard

Bernhard JWestland

JWestland NotThamesWater

NotThamesWater Dammit

Dammit

Soul

Soul edscoble

edscoble Brommers

Brommers crossedthread

crossedthread bq

bq boydsbikes

boydsbikes greentricky

greentricky

.

1 Attachment