-

• #3027

The low interest rate era will not last forever.

わはははは

-

• #3028

The low interest rate era will not last forever.

It might.

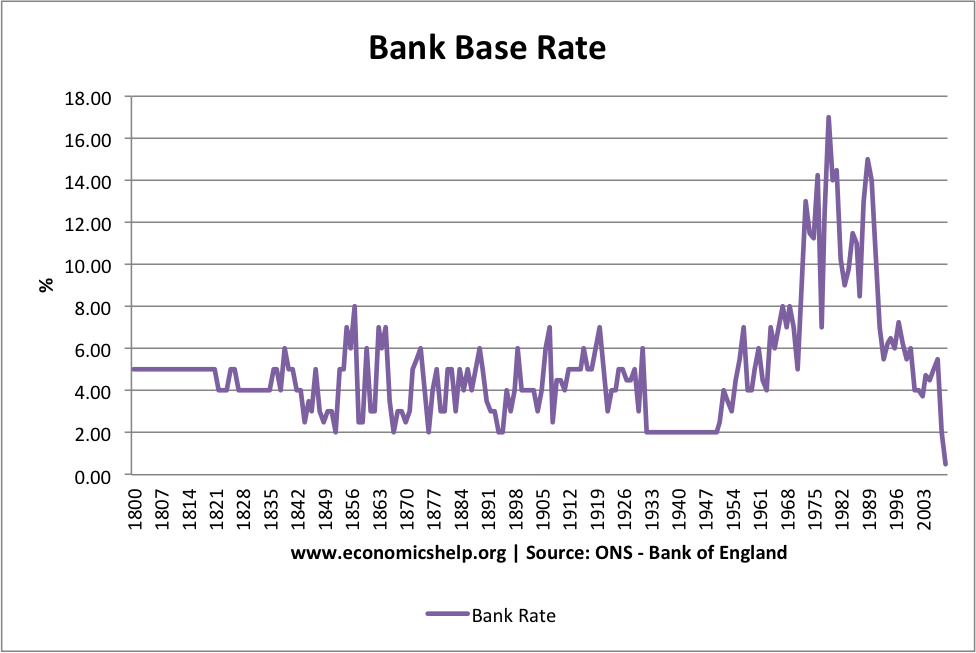

Here's the long term history. The high interest rates that we experienced in period between the oil crisis / end of Bretton Woods and joining the European Monetary System - when the £ was really free-floating and there was a belief that supporting it was a matter of national prestige - were the abberation.

Rampant asset price inflation since 1979 has reduced returns on everything. High interest rates would imply the stock market, the property market and other asset markets crash and stay crashed. I don't see it happening this side of a major reset of the global economy.

Of course those major resets do happen and they are not predictable, so you could still be right, just it would be a very big deal, not just a pendulum swinging gently back the other way.

I don't expect to ever buy an annuity, and I think that when Osborne stopped them being compulsory, he thought they had had their day.

-

• #3029

Japan is a good example of long term low interest rates.

With inflation going up rate rises in the near future as the economy normalises wouldn't surprise me. -

• #3030

In Japan?

Inflation still negative there, no?

https://tradingeconomics.com/japan/inflation-cpiInflation is going up here, but it's cost push, mainly due to brexit. Demand isn't driving it so increasing rates doesn't seem to make a lot of sense.

But you are right that some people are still saying we need interest rate rises so it might still happen. But a % or two, nothing like the 70s and 80s. And I would expect it to be quickly reversed if it did happen as it would trash growth.

I have to watch this for work and our assumption is no significant movement in the next couple of years. -

• #3031

mainly due to Brexit

Is this actually true? In normal times I wouldn’t question it, but the govt. has borrowed a fuck tonne of money and given it away to people for free. And there’s a massive backlog of stuff to do that simply wasn’t done in 2020. And there’s a global supply crunch on.

There’s massive demand for some things and normal demand for others combined with a shrunken workforce (some Brexit stuff there I guess), suppl troubles ( some Brexit stuff there) and a massive backlog. It is demand > supply.

I agree that crushing rate rises are unlikely.

-

• #3032

Why, despite the fact that Apple has 6 x grown ad revenue in last 6m is there share price not doing more?

1 Attachment

-

• #3033

Possibly because tech stock pricing models are often based on *potential* earnings, rather than actual earnings, which goes some way to explaining their inflated earnings ratios.

Also, if the ad revenue was *expected*, it would have limited impact, as it would have already been priced in.

-

• #3034

The earnings were unexpected and analysts seem to have been going wild for them.

-

• #3035

Thats probably because of all of the nosebag they've been doing.

For srs, though. Who knows. Market sentiment is weird, and price moves are even weirder.

Also dark pools, and lol that very big position holders don't all have inside info.

-

• #3036

There definitely are supply shocks with Brexit and Covid having led to disruptions and increased prices.

But yes, there is a debate as to whether demand is strong too and we are in a period of more uncertainty than usual following the economy crashing down in 2020, then re-starting this year. That rollercoaster will have had impacts that will take a while to be realised.

Some people are doing well - those who got full pay or generous furlough with nothing to spend it on - but not everyone or even most: average UK real wages are still at or below 2008 levels. And the government spending was mainly to compensate people for not earning when they weren't able to work rather than money being pumped into the economy (some was but lots of it went to the already-wealthy so squirreled away in savings or offshore and little impact on demand). UC cuts have just happened which will definitely reduce demand.

My hunch is that demand is not that strong and the supply disruption is the bigger factor - but we will find out, maybe next year!

-

• #3037

What’s caused moneysupermarket shares to plummet so much in the last few weeks?

-

• #3038

If I had to guess, lack of revenue due to nobody switching utility provider.

-

• #3039

Plus FCA ruling on insurance renewals kicking in next year. I hear they've been struggling for a while.

-

• #3040

Finally managed to get control of my Premium Bonds. Err, lol. Suffice to say that's still the total value in there...

-

• #3041

I have £5 worth bought in the late 70s (when I was born). Never won a thing. According to an online inflation calc that £5 would now be worth £ 31.86, not to mention any accrued interest. Terrible 'investment'.

-

• #3042

I had £5 since I was born (mid 70s), never won anything on them. Since I cashed in some bonds recently they sell off the oldest ones first, so my original bonds are gone, anything I have now has been bought in the last year or so. Boooo.

-

• #3043

Inflation likely to hit 5%

https://www.ft.com/content/bce7b1c5-0272-480f-8630-85c477e7d69c

Will it stop there I wonder?

-

• #3044

Unlikely, the damage is already baked in. 5% seems a very conservative figure right now.

-

• #3045

Buy the dip

1 Attachment

-

• #3046

This Shiba inu wallet bought$8000 of token about 13 months ago. With the recent mega pump it's worth $5.7bn to cash out. Apparently.

There's not enough liquidity in most cexs to do so I would wager plus it could be a lost wallet too.

Crypto is such a Ponzi scheme. Imagine trying to realise this and then using it for anything. (I'm just jealous)

"Ok sir you're buying this expensive house, could you please let us know the source of funds?"

" Yeah so I aped all in $8000 into this shit coin dog token Shiba inu 13 months ago. Cashed it out at $5.7bn, we good?"

1 Attachment

-

• #3047

'My alternative investment hedge fund has had a pretty good year'

-

• #3048

premium bonds are a joke. come over to shiba.

-

• #3049

" Yeah so I aped all in $8000 into this shit coin dog token Shiba inu 13 months ago. Cashed it out at $5.7bn, we good?"

you get an accountant and a lawyer, and yeah, you're good. a friend who had 10BTC from 2012 did this. paid some CGT and bought a house in Leyton

-

• #3050

Coinbase crashed yesterday and there's been a drop in the price of SHIB which could be they realised some of their wealth. Wonder how much... 1billion? 50 million?

NotThamesWater

NotThamesWater frank9755

frank9755 wildwest

wildwest Howard

Howard Tenderloin

Tenderloin

Jonny69

Jonny69 umop3pisdn

umop3pisdn cmburns

cmburns tallsam

tallsam Greenbank

Greenbank frankenbike

frankenbike Airhead

Airhead

ObiWomKenobi

ObiWomKenobi ChainBreaker

ChainBreaker @spiderpie

@spiderpie

Annuities work out well if you live well over average life expectancy, at the moment due to low interests rates they are particularly unattractive, this was not the case in the past and may not be in the future.

The low interest rate era will not last forever.