-

The low interest rate era will not last forever.

It might.

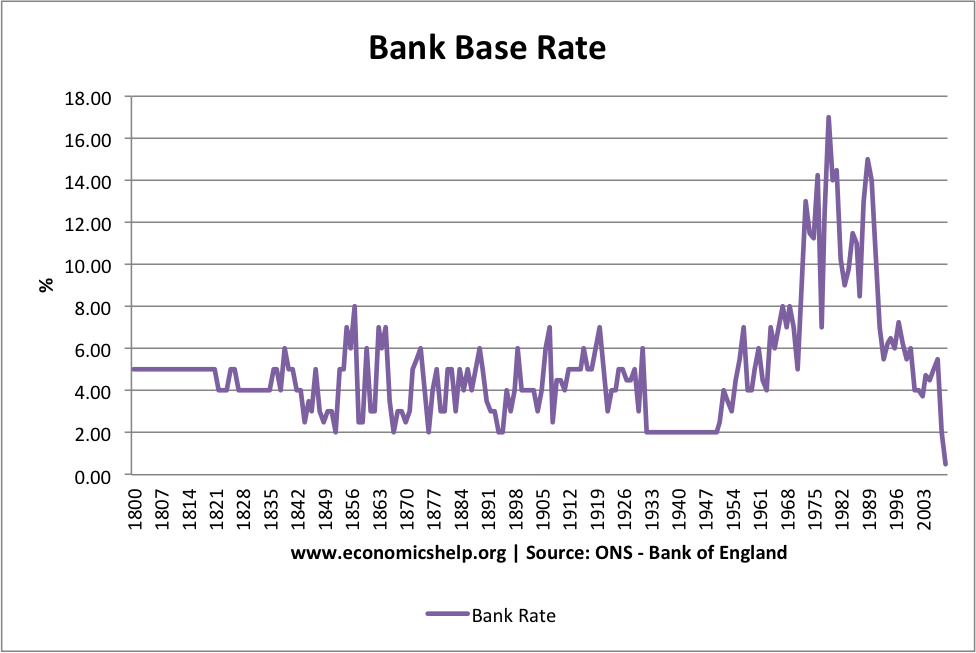

Here's the long term history. The high interest rates that we experienced in period between the oil crisis / end of Bretton Woods and joining the European Monetary System - when the £ was really free-floating and there was a belief that supporting it was a matter of national prestige - were the abberation.

Rampant asset price inflation since 1979 has reduced returns on everything. High interest rates would imply the stock market, the property market and other asset markets crash and stay crashed. I don't see it happening this side of a major reset of the global economy.

Of course those major resets do happen and they are not predictable, so you could still be right, just it would be a very big deal, not just a pendulum swinging gently back the other way.

I don't expect to ever buy an annuity, and I think that when Osborne stopped them being compulsory, he thought they had had their day.

You are reading a single comment by @wildwest and its replies.

Click here to read the full conversation.

wildwest

wildwest NotThamesWater

NotThamesWater frank9755

frank9755

Annuities seem like a terrible deal. You should be able to pretty safely withdraw £4k a year and still match inflation if you had £100k of S&S. Then when you die you've got a massive lump of S&S to pass on instead of the annuity which is presumably worthless.