-

Bitcoin pricing isn't based on supply/demand!

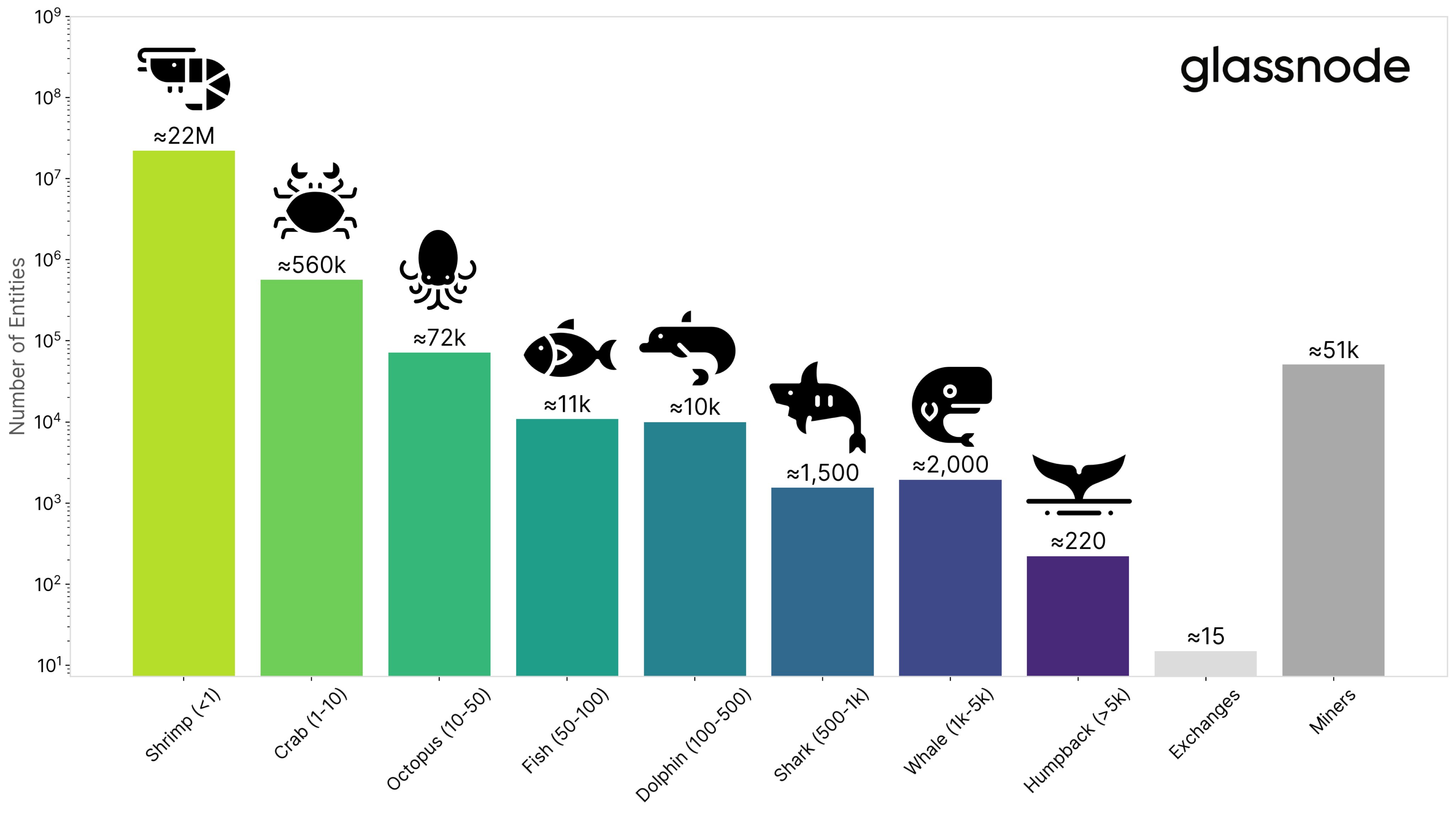

Around 2% of bitcoin accounts (that can be tracked) control 95% of the asset. That further breaks down into ~92% of the 2% of accounts being 'whales' and only ~7% of the 2% being exchanges (or what you might consider a free/fair market).

It's the wild west, be prepared to lose your hat!

-

If there is no supply (an artificial constraint by whales hodling) on exchanges and it is all being bought up OTC, how does that not drive up retail price?

I fully believe it is a manipulated market by whales

It's no different than De Beers and diamonds is it with the market kept artificially inflated by controlling supply and distribution

-

Around 2% of bitcoin accounts (that can be tracked) control 95% of the asset. That further breaks down into ~92% of the 2% of accounts being 'whales' and only ~7% of the 2% being exchanges (or what you might consider a free/fair market).

What’s the source for that? Not disputing btw, just keen to know more.

-

Around 2% of bitcoin accounts (that can be tracked) control 95% of the asset.

Debunked: https://mobile.twitter.com/n3ocortex/status/1356673243734822912

(apparently)

JonoMarshall

JonoMarshall greentricky

greentricky %~}

%~} hugo7

hugo7

There's a supply crunch coming, whats not to like, bitcoin is flowing off of exchanges and in to cold storage, paypal and greyscale are buying up more than is being mined for the last few months and paypal has only rolled out crypto to US so far, going to be fun a year ahead win or lose