-

• #827

I think what he’s getting at is that supply of different currency vendors increases. Which undeniably will affect currency values from different vendors. For an individual currency, printing more notes or “numbers” if you want to call it that causes hyperinflation.

-

• #828

Or, more simply, like in the dot com boom, there are too many unsustainable projects and the vast majority will fail leaving the best ones behind.

-

• #829

Yeah, that’s a better analogy than what they gave in the article. Hard to speculate what might make a successful market leader long term. I’m not against it at all, but just worry slightly about the volatility.

-

• #830

Expect supply chain and logistics to be the first large scale adopters

What problem is blockchain solving here that hasn't been solved already? What technology + procedure is going to be pushed out when blockchain comes in?

Genuinely interested. Like the guy says, to me anyway it's likely they need a ledger and a way of defining and enforcing contracts, not a distributed, anon ledger and self executing software contracts.

-

• #831

For an individual currency, printing more notes or “numbers” if you want to call it that causes hyperinflation.

It doesn't, because quantitative easing is controlled. Which is one reason why the analogy is bad.

Valid point regarding competing currencies tho ...

-

• #832

Or, more simply, like in the dot com boom, there are too many unsustainable projects and the vast majority will fail leaving the best ones behind.

I wonder how much credibility (or the perception of) will hold up currencies using older technology. I don't really understand (for instance) why the value of (old) Etherium didn't tumble when (new) Ripple rocketed? Are people 'shorting' or something? What am I missing?

-

• #833

My simple guess is that there's different kinds of stakeholders, not only investors who are betting on product A or B (it's not a zero-sum game, you could still bet on both), but also day/position/whatever traders, the buy and hodl types, etc

-

• #834

Hmm enterprise solutions for distribution systems are made bespoke so it doesn't have to be anonymous, nor are we talking necessarily self-executing contracts. It's mainly relatively inexpensive efficiency gains in terms of security and automation. You have truck A moving from building A to building B and it's all automated, registered, shielded off from a potential corruption attack. You'll have multiple notes validating a transaction instead of one central master-slave system checking things.

I also think enterprises are trying to take this blockchain for distribution as a first foray into blockchain just to get their hands dirty and try and see whatever potential there might be in it for them. This is just a quick guess you might find better info on the web.

-

• #835

Any trusted/recommended wallets for ripple?

(@Stonehedge) I might chuck a few pennies on Crown and Ripple. But I guess I can't use the Crown wallet for both.

-

• #836

I was at a talk where ages one of the guys had effectively used a blockchain system to protect vulnerable children and their info for a charity.

-

• #837

Also interested in this.

What exchange are you planning on buying ripple from?

-

• #838

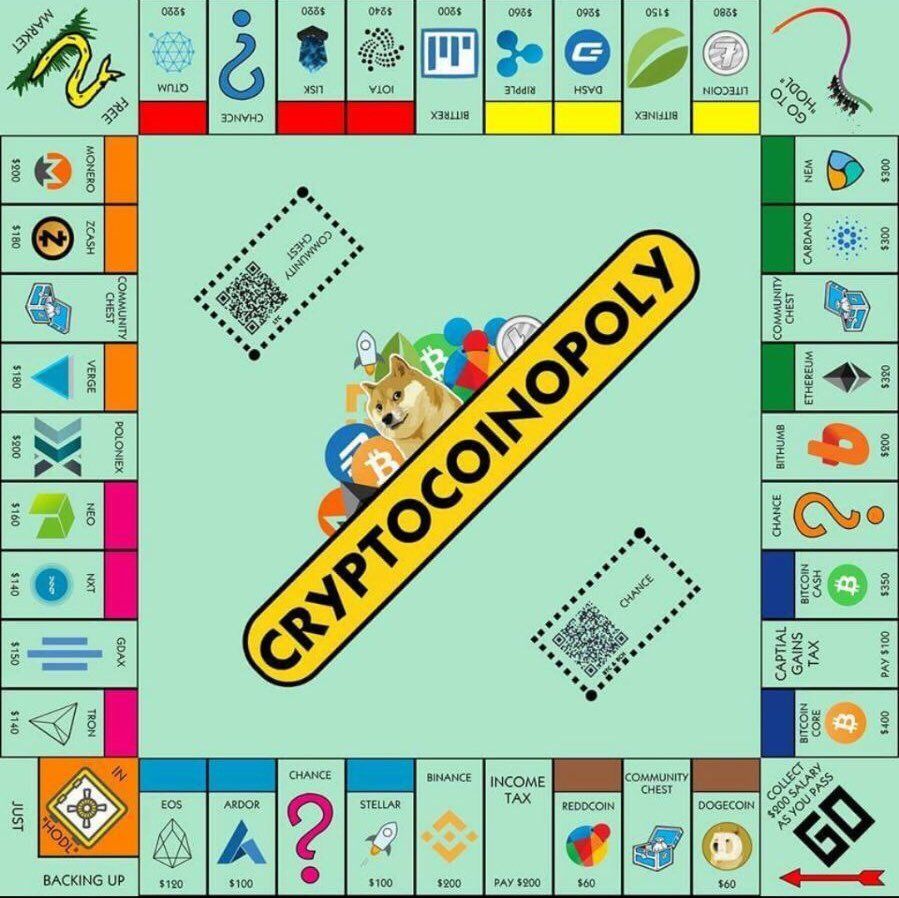

I too have bought ripple recently from binance, currently have Ripple, Stellar, and Etherium.

Got them from Binance, bought the ETH from coinbase and moved them tehre. -

• #839

I've looked at a few, lots seem to have a backlog, but I've joined cryptomate as that sells the two I was thinking about.

Looking at rippex for the ripple wallet. But ultimately getting something like the nano s ledger to store all coins offline.

It's a right headfuck. (especially this bizness of needing 20 ripple to open your ripple wallet or whatever)

-

• #840

Kraken

Pros:

- good value if in EU (usually best to use SEPA to transfer € as £ transfer costs are high and buying in £ has an insane spread)

- honest / unhacked to date

- margin trading

Cons:

- actually trading is 100% unreliable. Apparently it is being upgraded.

- no advanced trading functions anymore - ie stoploss, etc.

Basically if you are in the UK and you just want to buy and hold a currency and are happy to wait if the system is down then it's good. If you want to trade you should be aware that your orders may not be executed and if an order fails and you try again there's a risk it will be executed twice.

- good value if in EU (usually best to use SEPA to transfer € as £ transfer costs are high and buying in £ has an insane spread)

-

• #842

-

• #843

I remember when I signed up for a wallet 3 -4 years ago they gave you .01 of a bitcoin or something to get you started. Am I rich? Should I go hunting for that old wallet?

-

• #844

That's worth about a grand now...

Sorry my error it's about £100

-

• #845

Did the same thing. It’s a couple of cents now

-

• #846

Avoid

-

• #847

How come? Where else do you recommend?

Edit - just had an email from Coinbase saying they were unable to verify from identity. I used a photo of my drivers license.

-

• #848

Coinbase verification is completely hit and miss. I think I ended up going through the website rather than the app, but I also would suggest using something else if you can. They've got the simplest ui but their fees are huge compared to the likes of binance/bitfenix/others.

-

• #849

If you've not yet figured this out, Toast, despite the shitty UI is good.

-

• #850

Ha, I had found some info on Toast, and the shitty UI did scare me off a bit, despite positive comments. Maybe I'll have another look. Cheers .

rodabod

rodabod Stonehedge

Stonehedge Howard

Howard miro_o

miro_o Heldring

Heldring Hairingtons

Hairingtons hugo7

hugo7 farewell

farewell Shroom

Shroom boristrump

boristrump

Lebowski

Lebowski skydancer

skydancer kboy

kboy konastab01

konastab01 JB

JB @hippy

@hippy

How do u buy ripple?